End of financial year doesn't need to be stressful, so in MYOB there's not much you need to do.

But it's a good idea to take a few moments to make sure your books are in order, and everything's ready for your accountant at tax time.

Get started by completing your usual end of period tasks. For a calendar of key dates, checklists, videos and other great end of financial year resources, visit the MYOB hub.

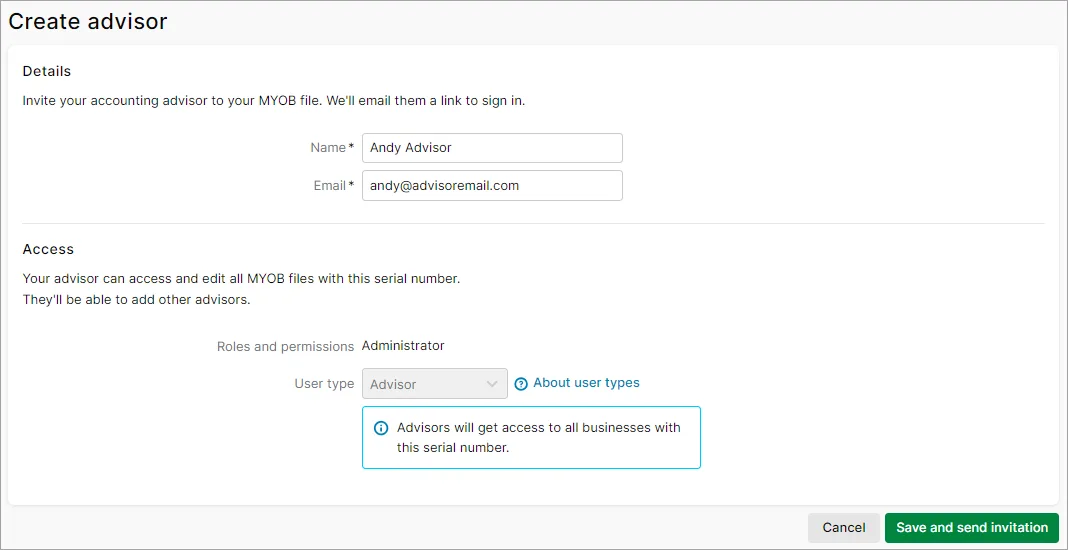

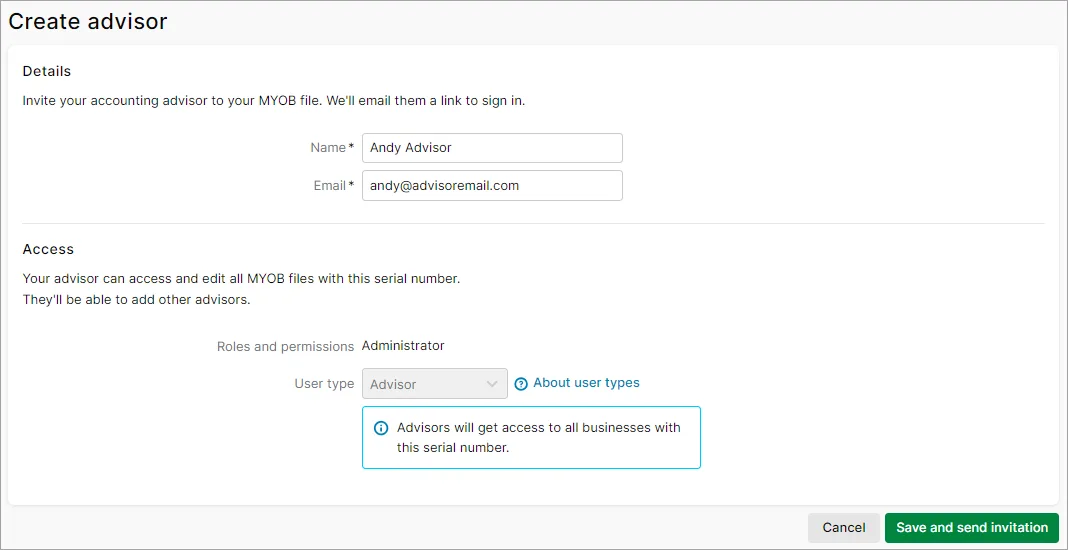

End of year wouldn't be the same without your accounting advisor, so why not invite them to your MYOB business?

They'll be able to log in and work directly with your data, so they can do your tax and make any required adjustments.

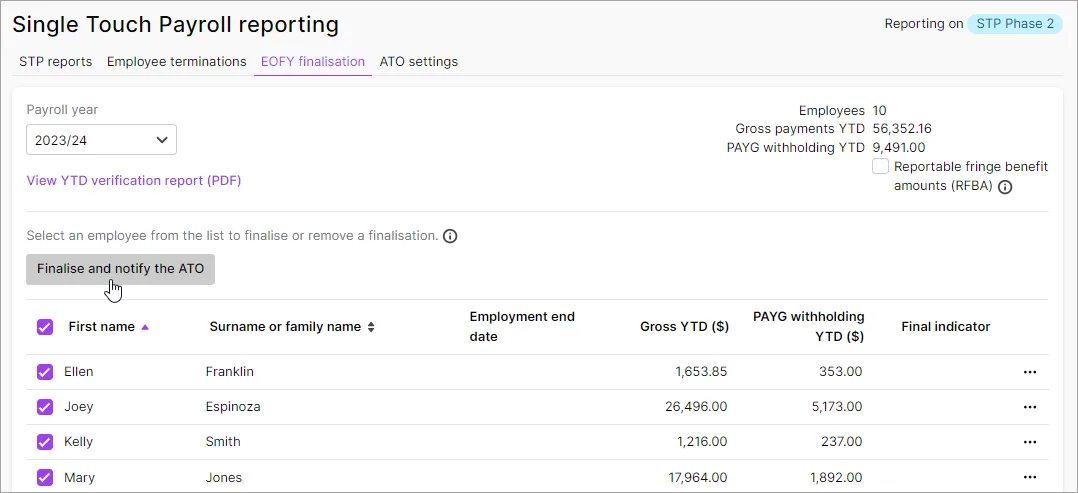

As part of Single Touch Payroll reporting, you need to finalise your payroll information, typically by 14 July. This lets the ATO know that you've completed all your pays for the payroll year.

Just check your year-to-date totals to make sure everything has been reported correctly throughout the year, then you're ready finalise in a couple of clicks.

Once you're done, your employees will be able to log into my.GOV to complete their tax returns.

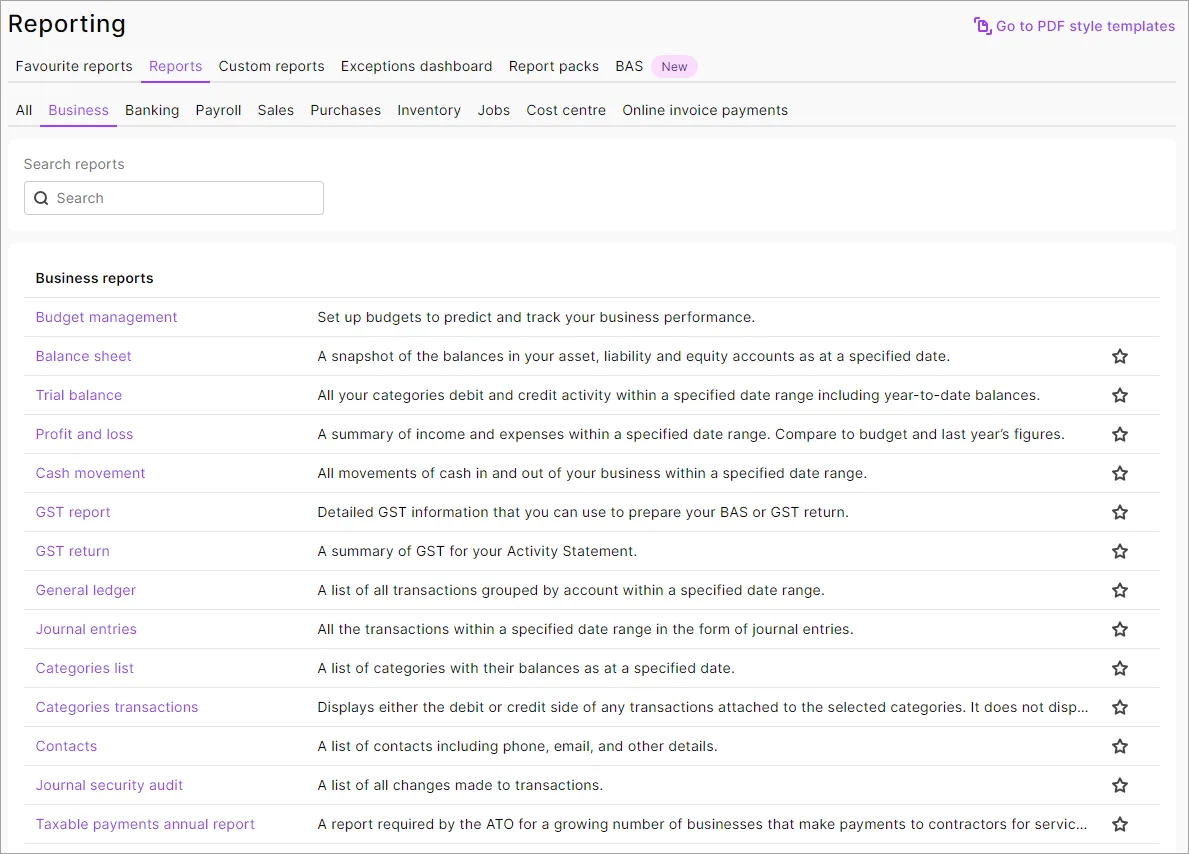

Your Profit and loss and your Balance sheet let you know how your business has performed throughout the year (which you've probably been checking regularly). You might like to print a copy for yourself.

Add all your EOFY reports to a report pack—so you can run them all at once and share them.

See Business reports to learn how to produce these reports.

Using inventory tracking?

The Stock on hand report tells you the on-hand quantities of your inventory items. Use it to help you do a stocktake.

When you're happy that your books are in order for another year, you can start a new financial year in MYOB. Just click the settings menu (⚙️) > Business settings > Start a financial year.

When you start a new financial year:

Here's a quick overview: